每年投2万连续投3年(200万投资一年收益8万好不好)

每年投200万,连续3年,能赚多少钱?解密公式!(年金系列一)

今日分享

Today's Share

没有什么比信仰更能支撑我们度过艰难时光了。

Nothing can be help us endure dark times better than our faith.

年金的定义

年金广义上指等额且定期支付的一系列现金流。我们生活中接触到的养老金发放、分期付款、分期还贷等都是年金收付的形式。根据每期收付时点与支付方式,年金可以分为:普通年金、先付年金与永续年金三种。我们应该掌握每种形式年金现值与终值的计算。

Annuity refers in a broad sense to a series of cash flows that are paid equally and regularly. Pension payment, installment payment and installment loan are all the forms of annuity payment in our daily life. According to the time and mode of payment, annuities can be divided intothree categories: ordinary annuity, prepaid annuity and perpetual annuity. We should master the calculation of present and final value of each form ofannuity.

(一)普通年金(Ordinaryannuity)

普通年金是指在每期期末收到等额年金。

Ordinary annuity refers to the equal amountof annuity received at the end of each period.

例子

计算持续三年、每年年末支付200元的年金终值与现值,利率为10%。

解析

计算不同年金的现值与终值必须画好现金流图

Example

The calculation lasts for three years, and the final and present value of the annuity of 200 yuan is paid at the end of each year. The interest rate is 10%.

analysis

To calculate the present and final value of different annuities, we must draw a good cash flow chart.

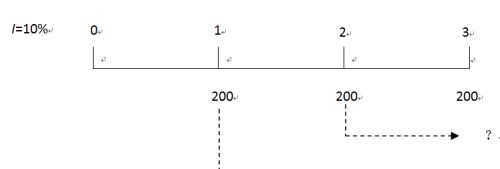

1.普通年金的终值(Final Value of Ordinary Annuity)

普通年金的终值:将每一期收到的现金流按复利形式折现到第3期末.见图

1. Final Value of Ordinary Annuity

Final value of ordinaryannuity: cash flow received in each period is discounted as compound interest until the end of the third period. as shown in the figure

比如,第一期末收到的200元,将按照10%的利率再投资两年,在第3期年末的价值是200×(1+10%)2。在第二期末收到的200元再投资1年在第3年年末的价值是200×(1+10%)。第3期期末收到200元。年金终值计算如下

For example, 200 yuan received at the end of the first period will be reinvested for two years at a 10% interest rate, and the value at the end of the third period will be 200 × (1+10%) 2. The value of the reinvestment of 200yuan received at the end of the second period for one year is 200 × (1+10%) at the end of the third year. 200 yuan was received at the end of Phase 3. Thefinal value of the annuity is calculated as follows

FV=200×(1+10%)2+200×(1+10%)+200=662

金融计算器操作(Financial calculator operation):

3→N;I/Y→10; PV→0;PMT→200;CPT;FV=-662

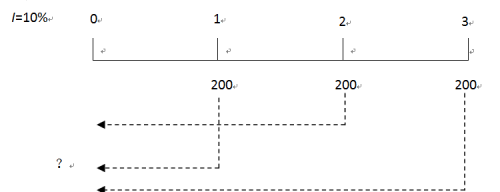

2、普通年金的现值(Present Value ofGeneral Annuity)

第1期末收到的200元,10%的利率折现到第1期初,即在第0期的价值是200×(1+10%)-1;第2期末收到200元,在第0期的价值是200×(1+10%)-2;第3期末收到200元折算到第1期期初,即在第0期的价值是200×(1+10%)-3;

At the end of the first period, 200 yuan was received,and the 10% interest rate was discounted to the beginning of the first period,that is, the value of the first period was 200 x (1 + 10%) - 1.

Atthe end of the second phase, 200 yuan was received, and the value in the secondphase was 200 x (1 + 10%) - 2.

Atthe end of Phase 3, 200 yuan was discounted to the beginning of Phase 1, thatis, the value of Phase 0 was 200 x (1 + 10%) - 3.

如下图,as shown in the figure

年金现值计算如下

(The present value of an annuity is calculated as follows)

PV=200×(1+10%)-1+200×(1+10%)-2+200×(1+10%)-3=497.37

金融计算机操作(FinancialCalculator Operation)

3→N; I/Y→10; FV→0;PMT→200;CPT;PV=-497.37

内容来源于网络公开信息。

风险提示:本文仅作为知识分享,不构成任何投资建议,对内容的准确与完整不做承诺与保障。过往表现不代表未来业绩,投资可能带来本金损失;任何人据此做出投资决策,风险自担。如有侵权请联系我们,我们将及时处理。

The content comes from publicly available information on the Internet.Risk tip: this article is only for knowledge sharing, does not constitute any investment advice, and does not promise and guarantee the accuracy and integrity of the content.Past performance is not indicative of future performance and investment may result in principal loss;Anyone makes an investment decision based on this, at their own risk.If there is any infringement, please contact us and we will deal with it in time.

温馨提示:通过以上关于每年投200万,连续3年,能赚多少钱?解密公式!(年金系列一)内容介绍后,相信大家有新的了解,更希望可以对你有所帮助。